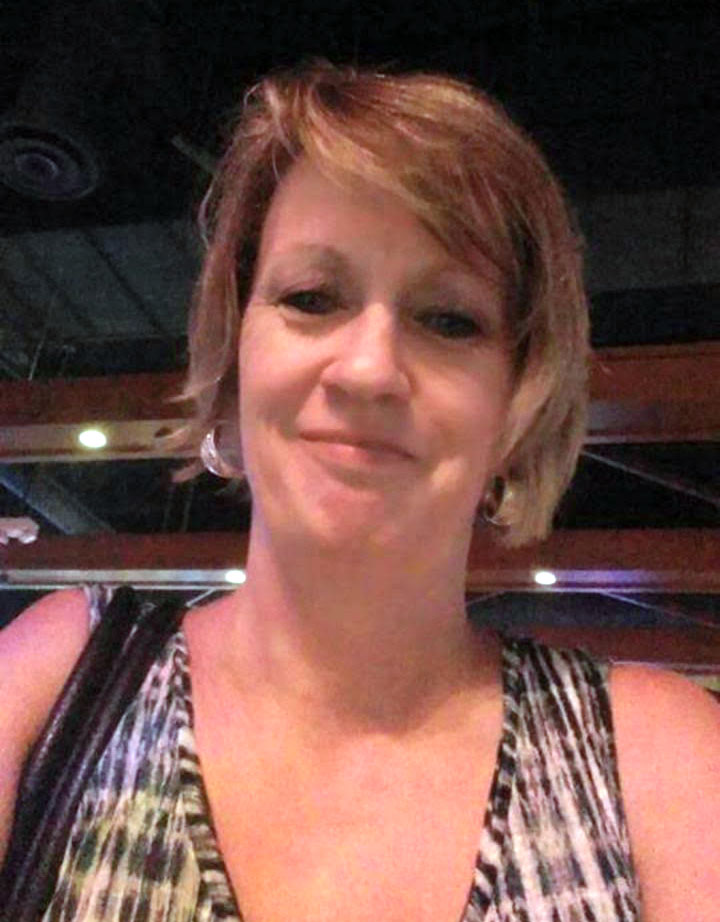

Kansas Stories: Pam

July 2024

Pam is a mother and grandmother from Pittsburg who works part-time as a home health care aide. As a health care aide she takes care of people with disabilities or chronic illnesses to help them with daily living activities like bathing, preparing meals, changing bandages or dressings, and some housekeeping work, like laundry, washing dishes and vacuuming.

Pam’s work is valuable to her community and those she cares for. But she is not eligible for employer-sponsored health insurance because of the way her job is setup in Kansas. At one time Pam was able to purchase health insurance through the Health Insurance Marketplace, but then she reduced her hours due to her own health issues.

Now she doesn’t make enough to qualify for financial help on the Marketplace, but she doesn’t qualify for Medicaid, either. Her only option would be to pay full price for a Marketplace plan, but she can’t afford to do that. Like many other working age Kansans, Pam now lives in the health insurance coverage gap.

Pam wishes she could work more, but her medical issues don’t allow her to do so. She had scoliosis as a child and has had a hip replacement. She also has high blood pressure, arthritis, asthma and Chronic Obstructive Pulmonary Disease (COPD).

“I’ve struggled with this situation most of my life,” Pam said. “I was born with a birth defect hip issue that could have been resolved had I always been able to get health insurance, and kept my hip longer…[I could have] worked more years if I had had the insurance I needed. It may not have stopped it completely, but it could have improved my ability to work longer.”

Pam receives medical bills daily that she struggles to pay. Currently she has about $8,000 in medical debt. She’s avoided getting a much-needed MRI and sleep study because she fears finding herself in more medical debt. Sometimes she skips buying her prescriptions because of the cost. Her doctor would also like her to start physical therapy to help with her chronic back and hip pain, but without health insurance she has not been able to access that care.

Because she has COPD, Pam needs oxygen at night, but without health insurance she must pay out-of-pocket. Her oxygen is $400 per month, and being uninsured means sometimes she has to choose between paying for basic necessities or paying for the oxygen.

Pam’s chronic asthma makes her more susceptible to pneumonia. Last winter she was very sick and needed to go to the hospital immediately, but drove herself instead of calling an ambulance because she was worried about the cost of an ambulance ride without health insurance coverage.

Pam knows that her life would be very different if she had access to affordable health insurance.

“I may be able to work more if I didn’t hurt as bad as I do, and then I would maybe need less in other public assistance,” she said. “It would take away the fear that my bank account may be garnished. It could make my life a bit more than just an existence.”

Pam is still at an age where she can work, and she wants to be a productive member of the workforce. Her medical issues are all treatable, but without health insurance her ability to work is impaired. By expanding Medicaid in Kansas, Pam would be able to stay in the workforce and work more hours, improving her quality of life and the community she lives in.